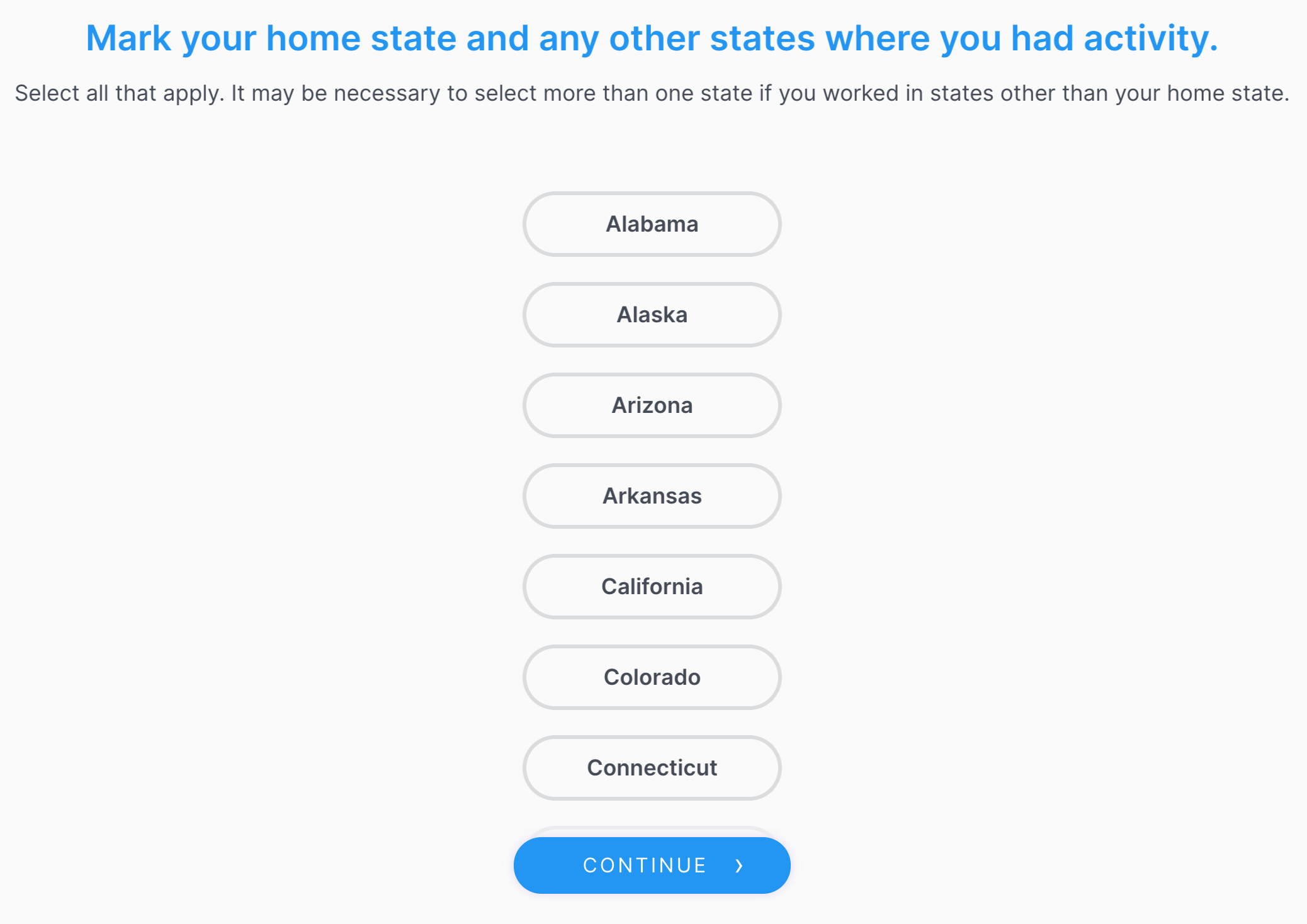

When filling out our questionnaire for a tax job you can add what state you need to file returns for.

If you need to file state tax returns along with your federal tax return, Taxfyle provides a way for you to indicate what states you need completed during onboarding.

Filing state tax returns is an important step for many individuals, as state tax obligations vary and may require separate filings in addition to the federal return. By indicating your state filing requirement within Taxfyle, you can receive comprehensive assistance from your assigned Tax Pro, who will have the necessary knowledge and expertise to handle both federal and state tax matters.

If your state is not indicated or you need additional states here is how we can help!

-

State Not Indicated: If you realize that a state return needs to be filed but you didn't indicate it during the job submission process, you're assigned Tax Pro will notify Taxfyle about the update required in the engagement details.

-

Correcting the Quote: Once Taxfyle is notified about the state filing requirement, they will update the engagement details to reflect the additional state return. This allows for the correction of the quote provided to you initially, ensuring that it accurately reflects the scope of work required for both federal and state filings.

-

Notifying Taxfyle: If your engagement doesn't require a state return initially indicated during the job submission, you or your assigned Tax Pro can notify Taxfyle about the update needed in the engagement details. This allows Taxfyle to make the necessary adjustments and correct the quote accordingly.

By notifying Taxfyle about any changes or additions to the state filing requirements, you can ensure that your engagement details are accurately reflected, and your quote is adjusted accordingly. This helps provide transparency and clarity regarding the services and fees associated with your tax filing process.